BankLink

The BankLink app provides functionality to connect to banking institutions and upload bank transactions directly into Business Central, without the need to download files or register and login to bank portals.

The direct connection between Business Central and banks is established securely via Open Banking protocol, in accordance with the European PSD2 regulations.

Over 2,500 banks in more than 30 countries are supported (Europe and UK).

Bank transactions are downloaded into the standard Business Central pages related to bank transactions, allowing the use of standard reconciliation features, including smart reconciliation matching with Copilot.

Discover BankLink: banklinkbc.com.

Installation and activation

BankLink can be installed directly from the official AppSource marketplace.

After installation, follow the assisted setup wizard to activate a subscription and proceed with the basic configurations.

BankLink requires an active subscription, which allows the app to connect up to 3 banks simultaneously in a single Business Central tenant.

If you need to connect more than 3 bank accounts, you can activate additional bank connections.

A 30-day trial can be activated, during the trial all the app features are enabled and you can connect up to 3 bank accounts for free.

The pricing is as follows:

- Base BankLink license: 40 euros/month, for up to 3 active bank connections.

- Additional bank connections: 10 euros/month.

Payment can be made via bank transfer or credit card. Subscription activation via credit card is made throught the online activation process.

In the case of payment by bank transfer, you can request activation at the email address info@banklinkbc.com. After payment, a license key will be provided for app activation.

Assisted setup

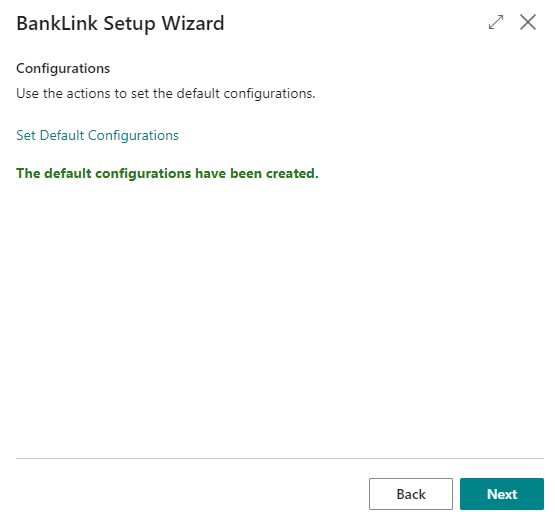

The assisted setup provides a guided configuration for the main features of the app. It is automatically executed following installation or can be launched from the main configuration screen BankLink Setup.

The wizard initially involves setting the default configurations, including the configuration of the default country to be used for connecting to the relevant banking institutions.

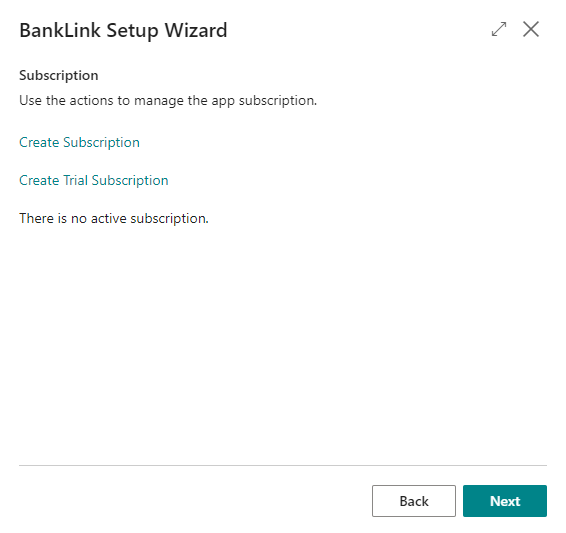

You will then need to proceed with the activation of a subscription, or activating the 30-day free trial.

More details on activating a subscription can be found in the specific section: subscription management.

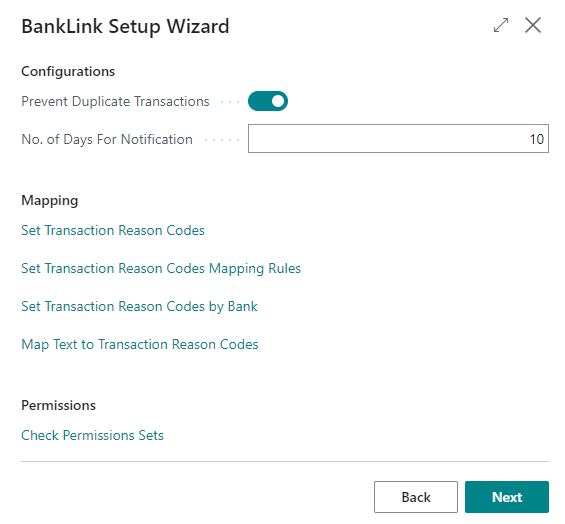

Next, you can proceed with general configurations, specifically:

- Prevent Duplicate Transactions: during the upload of bank transactions, movements that have already been downloaded based on the internal ID assigned to the transaction will be discarded.

- No. of Days for Notification: how many days in advance expiring bank connections will be shown in the specific cue of the role center.

In the mapping section, you can perform mapping configurations between bank transaction descriptions and their corresponding codes, as described in the specific section: transaction codes.

In the permissions section the authorization sets related to the app are displayed, which should be assigned to users who will be allowed to use it.

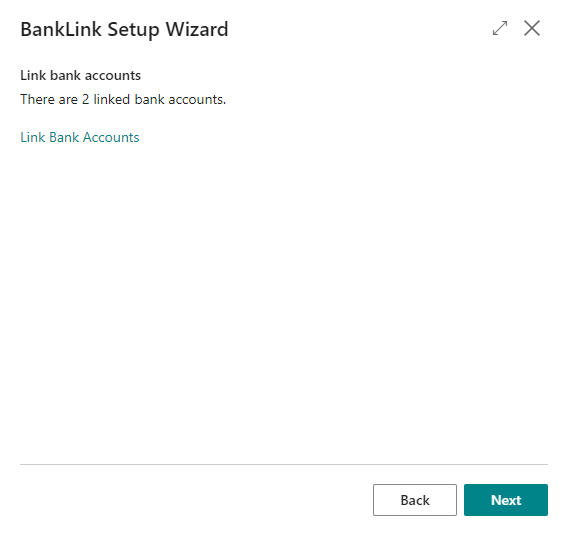

Finally it is necessary to configure the automatic connection of the banks for which you want to perform automatic transaction uploads in BC.

The connection is made by launching the appropriate action for the selected bank and following the guided procedure as described in the specific section: bank connections.

Confirming the assisted setup will save the configurations, and you can start using the features of BankLink.

Role Center Activities

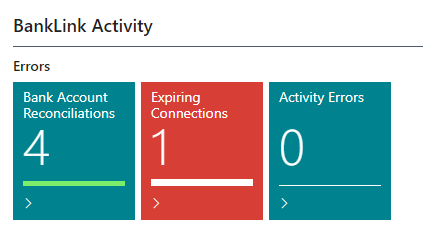

In the activities of the accounting role centers there is a section for BankLink, which quickly display the informations regarding:

- Bank Account Reconciliations: unreconciled reconciliations created in BC.

- Expiring Connections: if there are any expiring connections requiring renewal, they will be shown in this cue. Connections are displayed in this screen based on the number of days indicated in BankLink Setup.

- Activity Errors: if activity logging is enabled in BankLink Setup, any connectivity errors occurred during the day is displayed in this cue.

Permission sets

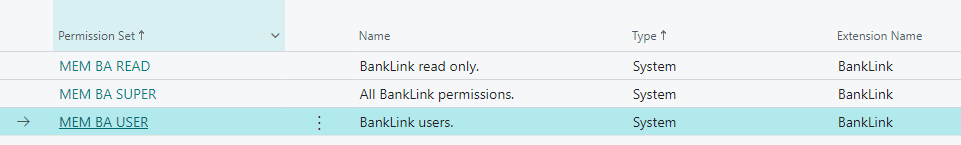

Three predefined permission sets are available for the most common functionalities:

- BankLink Read-Only: allows access to the app’s functionalities in read-only mode.

- BankLink Super User: allows the use of all app functions and configurations.

- BankLink Users: allows the use of all app functions without the ability to change configurations.

It is recommended to configure permissions for users immediately after installing the app; otherwise, errors related to missing permissions may occur.

Support

For any information or support request, please write to support@banklinkbc.com.