Bank Connection

The connection to banking data for retrieving transactions is based on establishing a secure connection via the Open Banking protocol with the relevant banking institution.

During the connection process, you must authenticate with the bank and grant the BankLink app permission for read-only access to banking data.

The established connection remains valid for 180 days or until revoked by the bank or the user. After this validity period, a new connection must be established by logging in again with the banking institution.

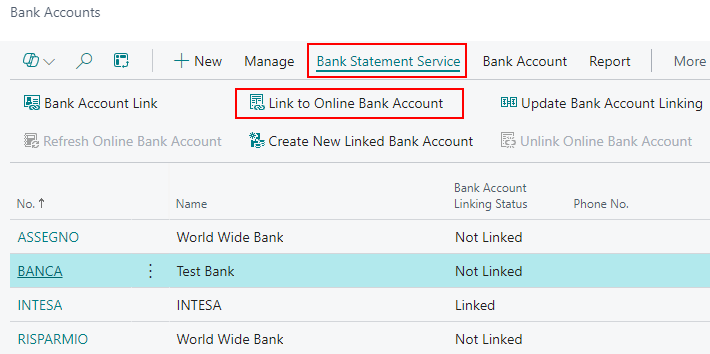

The connection is established from the bank account through the appropriate action.

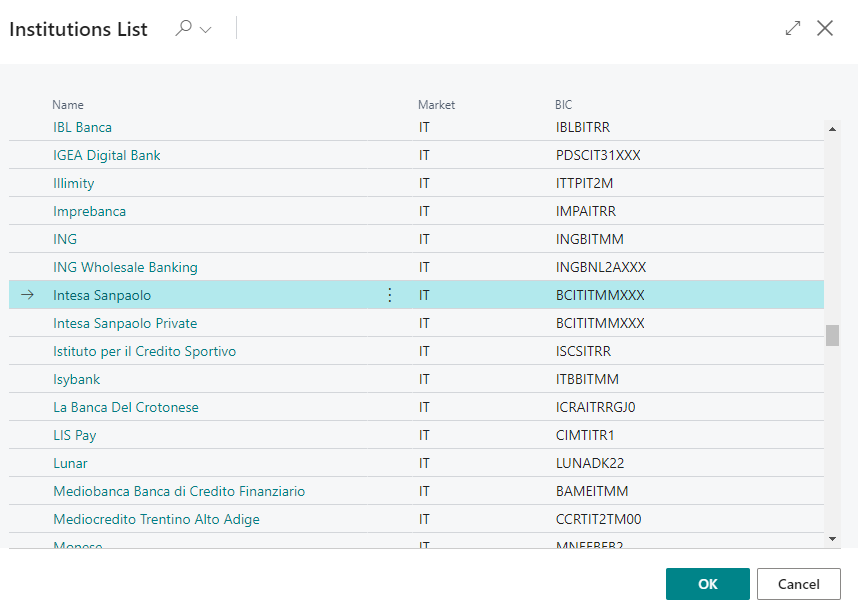

It is then necessary to select the banking institution to connect to; the list displays all available banking institutions for the enabled countries. The default configuration enables the country corresponding to the current company based on the Company Information screen.

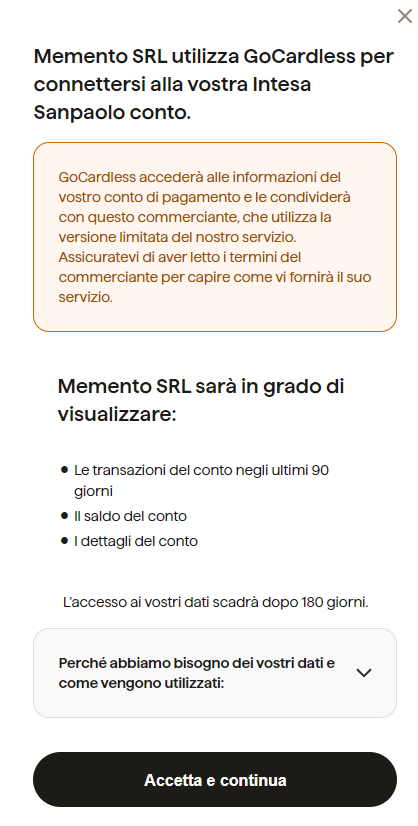

After selecting the bank, the authentication process with online banking is executed in a new window.

During the authentication process, the bank will request the online home banking credentials to authenticate and authorize BankLink to download the transactions..

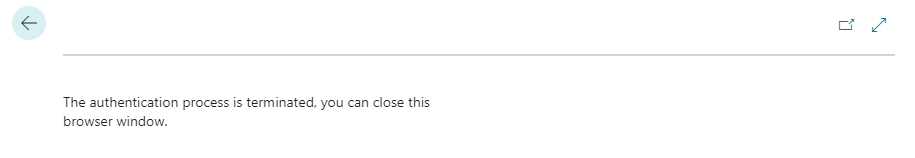

After the authorization is completed, you can close the new window and confirm the successful authentication in the original window.

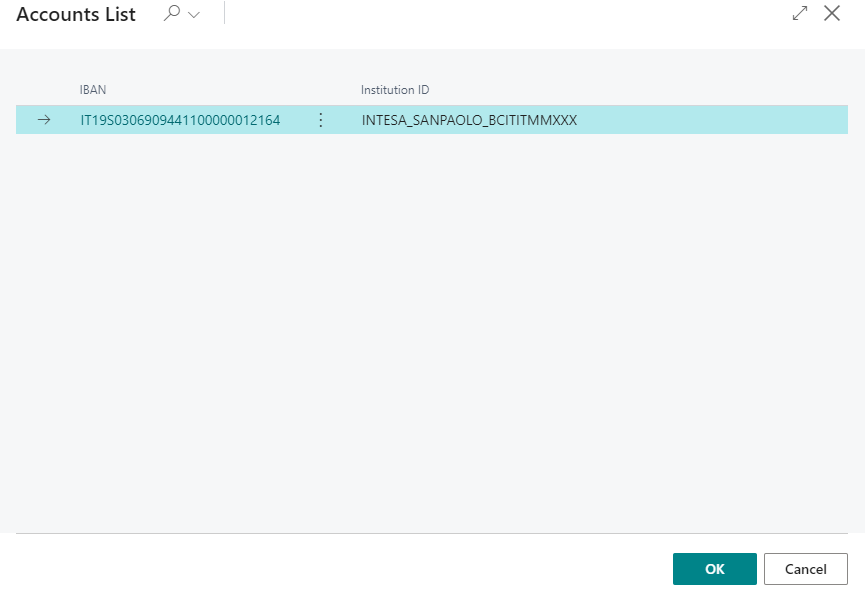

A list of available bank accounts with the selected bank will then be displayed, allowing you to choose the account to connect.

Additional Configurations

Following the successful connection, additional configurations can be made regarding the established bank link.

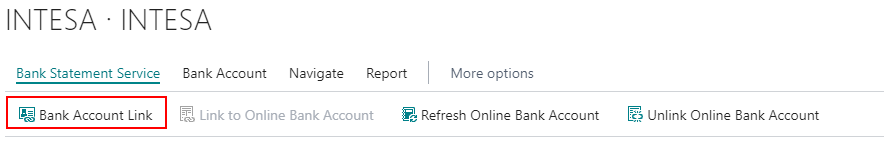

The configuration page can be opened from the bank account card with the action Bank Account Link.

In the connection section, the main information related to the active connection and the expiration of the link is available.

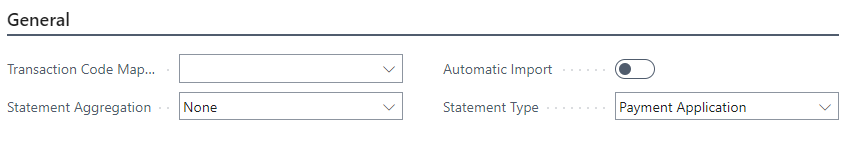

In the general section, the following possible configurations are present:

- Automatic Import: enables the automatic import of bank transactions, if it has been configured.

- Statement Type: allows you to specify whether the transactions should be downloaded into bank reconciliations or into the standard payment reconciliation journals of Business Central.

- Statement Aggregation: allows you to specify any aggregation logic for the transactions in the statements — this means you can download transactions without aggregation, aggregate all transactions into the first statement for the bank if available, or with temporal aggregation by day/week/month.

- Transaction Code Mapping Rule: the rule that should be used for extracting transaction codes from the data returned by the bank, as described in the relevant section on transaction codes.

Bank Connection Update

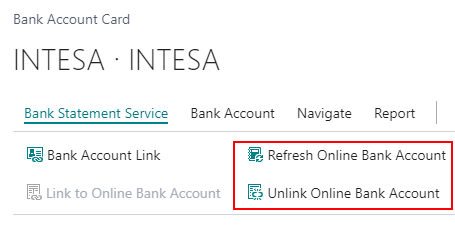

It is possible to update the bank connection (before or after expiration) through the specific functionality available on the bank account card.

Additionally, it is also possible to disable an existing connection in the same way through the appropriate action.