Transaction codes

Bank transactions are downloaded according to the format returned by the banks and subsequently normalized (based on the Berlin Group format).

However, individual banks have the freedom to populate standard fields in specific ways, making further transcoding necessary to enable advanced automation in transaction identification.

Utilizing the features related to transaction codes enables the automatic application of additional logic to the standard reconciliation functionalities of Business Central. The use of transaction codes requires preliminary parameterization to map the incoming information from the bank to the specific transaction codes.

The main use cases are:

- Automatic application of specific GL accounts for posting transactions, such as for bank fees, interests, etc.

- Definition of rules for extracting transaction text to be used for matching with posted documents.

- Improvement of matching rules and related performance by linking specific types of transactions to the reconciliation of only customer or supplier entries.

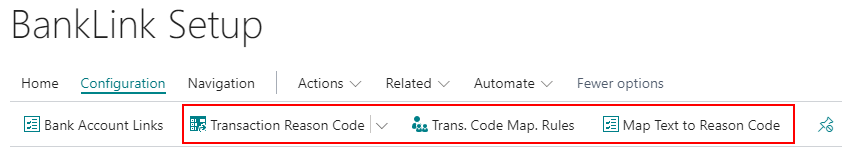

The configuration of transaction codes is carried out from the BankLink Setup page.

It is also possible to perform configurations from the payment reconciliation journals page using the appropriate actions.

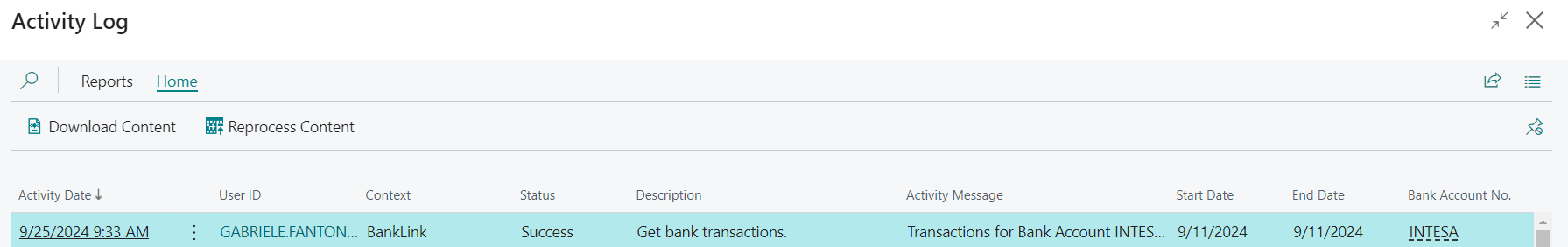

Activity Log

The activity log is used for saving the history of bank transaction activities, and the detail of the transaction content received from the bank.

In this way it is possible to verify the original format returned by the bank and proceed configuring the mapping rules with transaction codes, as described in the following paragraphs.

The log activation occurs in the BankLink Setup page through the field Enable Activity Log.

The activity log can be viewed from the same page via the Activity Log action.

The page displays a list of remote reading operations performed and any errors encountered during the transaction upload process.

In the page, the following actions are available for the configuration of transaction codes:

- Download Content: downloads the content of the transactions returned by the bank in JSON format, so that it is possible to verify where the information to be used for reading the codes is located.

- Reprocess Content: removes any unposted transactions from the journals and regenerates them from the data returned by the bank. This functionality is useful for testing the configuration of codes without the need to read remote transactions, considering that banks set a limit on the number of daily readings that can be performed.

It's possible delete entries from the activity log using the actions or using the standard Retention Policies functionalities.

Transaction codes management

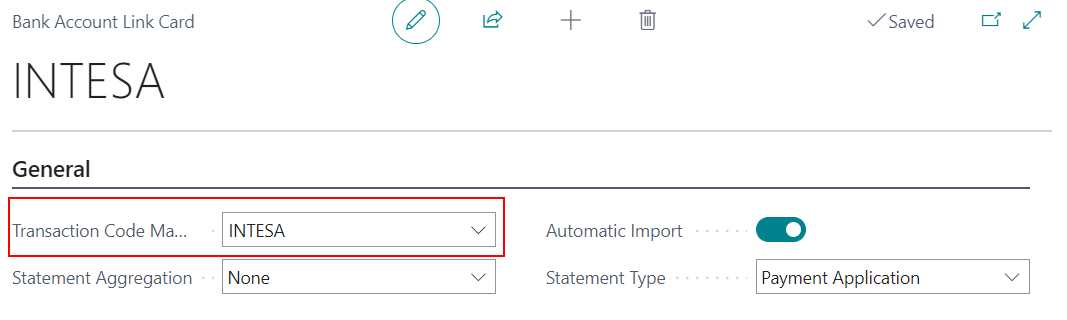

The first step to identify the transaction code is to specify, in the bank connection configuration screen, the mapping rule to be used for identifying the code.

Mapping rules are used to specify from which field the text shoule be read to extract the transaction code.

For example, considering that the bank returns transactions in the following format:

''' { "transactionId": "2024-09-09-00.00.00.000001_20240909_20240909", "bookingDate": "2024-09-09", "valueDate": "2024-09-09", "transactionAmount": { "amount": "5000.00", "currency": "EUR" }, "remittanceInformationUnstructured": "ACCR. BEU COD. DISP.: 0124090925307239 CASH 15 Fattura 24FV00078 Bonifico a Vostro favore disposto da: MITT.: Cliente SPA BENEF.: MEMENTO SRL", "internalTransactionId": "d1d9d029adaa95ac034f62c022643df6" } '''

In this case, the transaction code could be identified from the text ACCR. BEU COD. DISP, meaning that, generally for this bank, the codes would be extractable from the remittanceInformationUnstructured field.

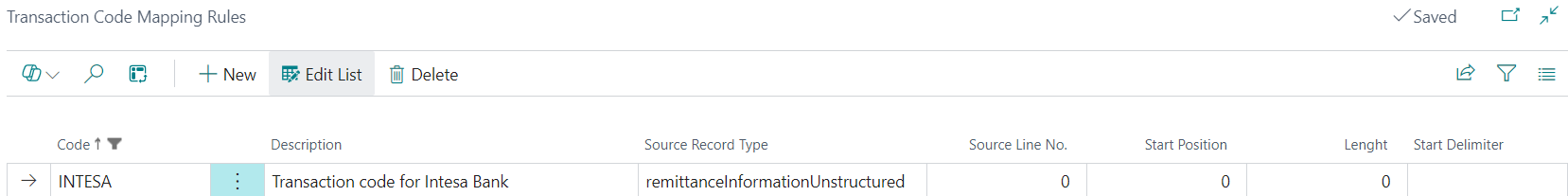

Therefore, the mapping rule could be configured as:

- Source Record Type: remittanceInformationUnstructured in order to attempt to read the transaction code from the content of that field.

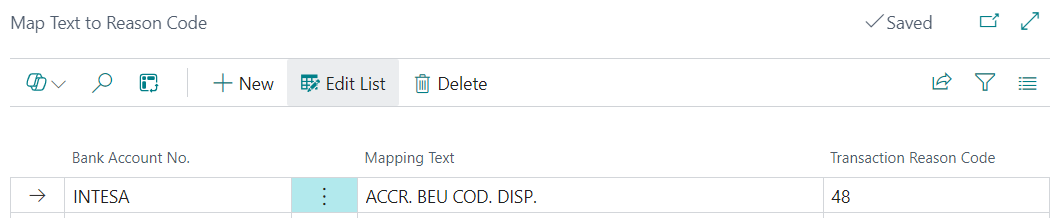

The text from the extracted string is compared with the configurations available in the text-to-code mapping screen.

In this screen, it is possible to specify, for each individual bank, which transaction texts should be mapped to the various codes.

In this case, for example, the text ACCR. BEU COD. DISP has been mapped to code 48.

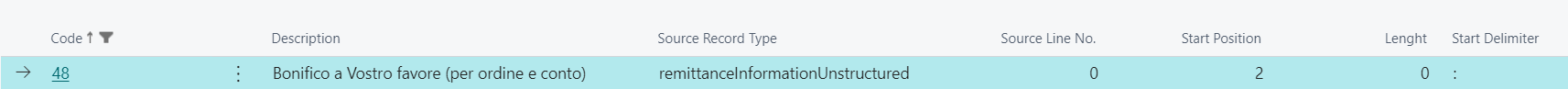

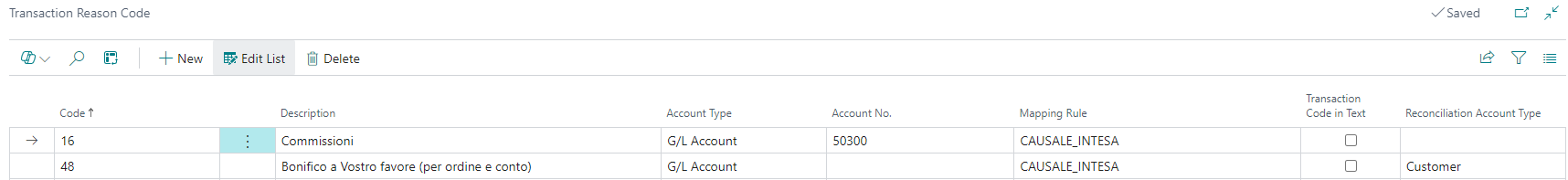

The code is then configured based on the type of mapped transaction. In this case, for example, it is mapped to reconcile only customer ledger entries, and it has a mapping rule that specifies reading the transaction text (used for reconciling with the accounting entries present in the system) starting from the first character : in the description of the remittanceInformationUnstructured field.

Transaction Code

Nella maschera Causale Transazione vengono censite le causali e le relative regole di riconciliazione.

- Tipo conto e Nr. Conto: nel caso in cui le transazioni delle causale debbano essere registrate su un conto fisso (ad esempio commissioni, etc), è possibile configurarlo in questi campi. Il livello di affidabilità nella riconciliazione per questo tipo di transazioni sarà Alto.

- Causale transazione in testo: indica se inserire nel testo transazione della riconciliazione il codice della causale. Viene utilizzato per poter applicare diversi configurazioni di mappatura testo a conto a seconda della causale.

- Tipo conto riconciliazione: se popolato, la riconciliazione viene effettuata solo con i movimenti contabili del tipo selezionato riducendo gli errori ed aumentando le performance.

- Regola di mappatura: identifica la regola con cui viene estratto il testo transazione (usato dalle funzionalitàù di riconciliazione) dai dati caricati dalla banca.

E' anche possibile definire delle regole diverse per le causali per ogni banca nella maschera Causale Transazione per Banca.

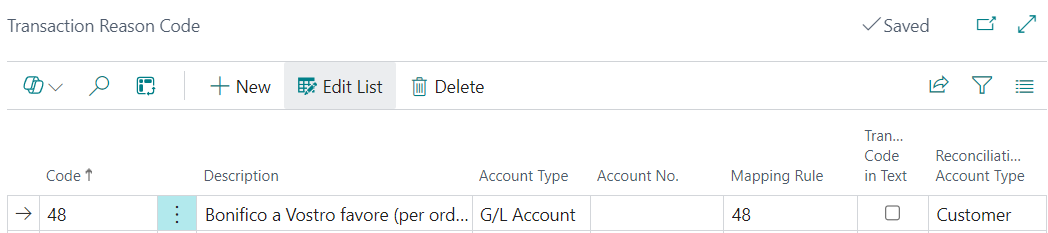

In the Transaction Code page, the codes and their corresponding reconciliation rules are configured.

- Account Type and Account Number: if the transactions should be posted in a fixed account (for example, commissions, etc.), it can be configured using these fields. The level of confidence in reconciliation for this type of transaction will be High.

- Transaction Code in Text: whether to include the code of the transaction in the reconciliation transaction text. This is used to apply different text mapping to accounts configurations based on the transaction code.

- Reconciliation Account Type: if populated, reconciliation is performed only with accounting entries of the selected type, reducing errors and increasing performance.

- Mapping Rule: identifies the rule by which the transaction text (used by the reconciliation functionalities) is extracted from the data loaded by the bank. It is also possible to define different rules for the codes for each bank in the Transaction Code by Bank screen.

Text to code mapping

In this page the texts pthat are in data loaded from the bank are configured to identify the transaction codes. The Text Mapping field should be filled with the text used for mapping.

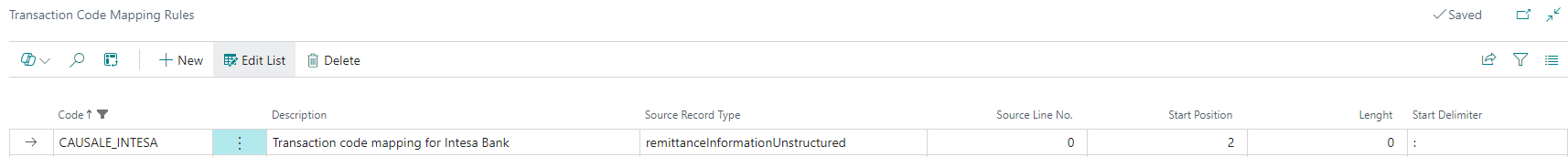

Transaction Codes Mapping Rules

In this screen, the reading rules are configured:

- Source Record Type: specifies from which type of field to read the data.

- Source Line Number: if the record type remittanceInformationUnstructuredArray has been selected, you can indicate which line of that element to read from.

- Starting Position: the character from which to start reading the data.

- Length: the fixed length of the data to be read, if needed.

- Start Delimiter: the string to be used to identify the start of the field, if needed.